They offer similar hardware and POS services. Stripe is better for developers, and Square is better for those without coding experience. They charge the same for online payments.

Many business owners find Square a little easier to jump into and get working immediately, but it lacks Stripe’s payment versatility. In contrast, Square focuses on providing hardware POS systems for brick-and-mortar businesses or larger online enterprises. It offers reasonably low rates and a variety of mobile-focused and online-focused tools, including the following: Stripe is a relatively new payment processing company compared to most of its competitors. This comparison page should help you determine which payment processor best fits your business needs.Įditor’s note: Looking for the right credit card processor for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs. With that in mind, let’s take a closer look at Stripe and Square. Both services come with unique benefits and have different advantages and downsides. Stripe and Square both offer a single merchant account and allow you to accept payments through online point-of-sale (POS) stations or portals. Small businesses sometimes have trouble choosing between two of the biggest names in the industry: Stripe and Square.

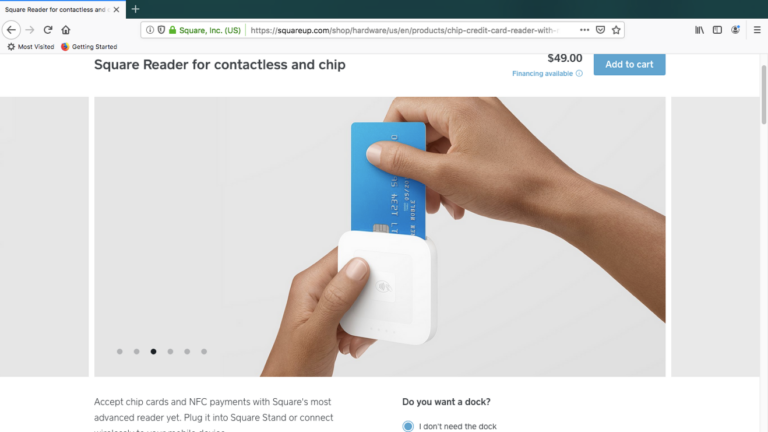

If you run an online or retail store, you need a small business credit card processor that will let you accept credit card payments as well as debit cards and other payment types. This article is for small business owners exploring payment processing options.Stripe is easy to use and versatile Square is also easy to use, but it’s not quite as versatile in terms of accepted currencies.Square focuses on providing hardware POS solutions for brick-and-mortar businesses or larger online enterprises.Stripe specializes in mobile- and online-focused payment processing tools.

0 kommentar(er)

0 kommentar(er)